Banking CX Automation Solutions

AI-powered CX Automation for banking and capital markets. Elevate CX while improving efficiencies and compliance across your contact center, branch, back office, and digital teams.

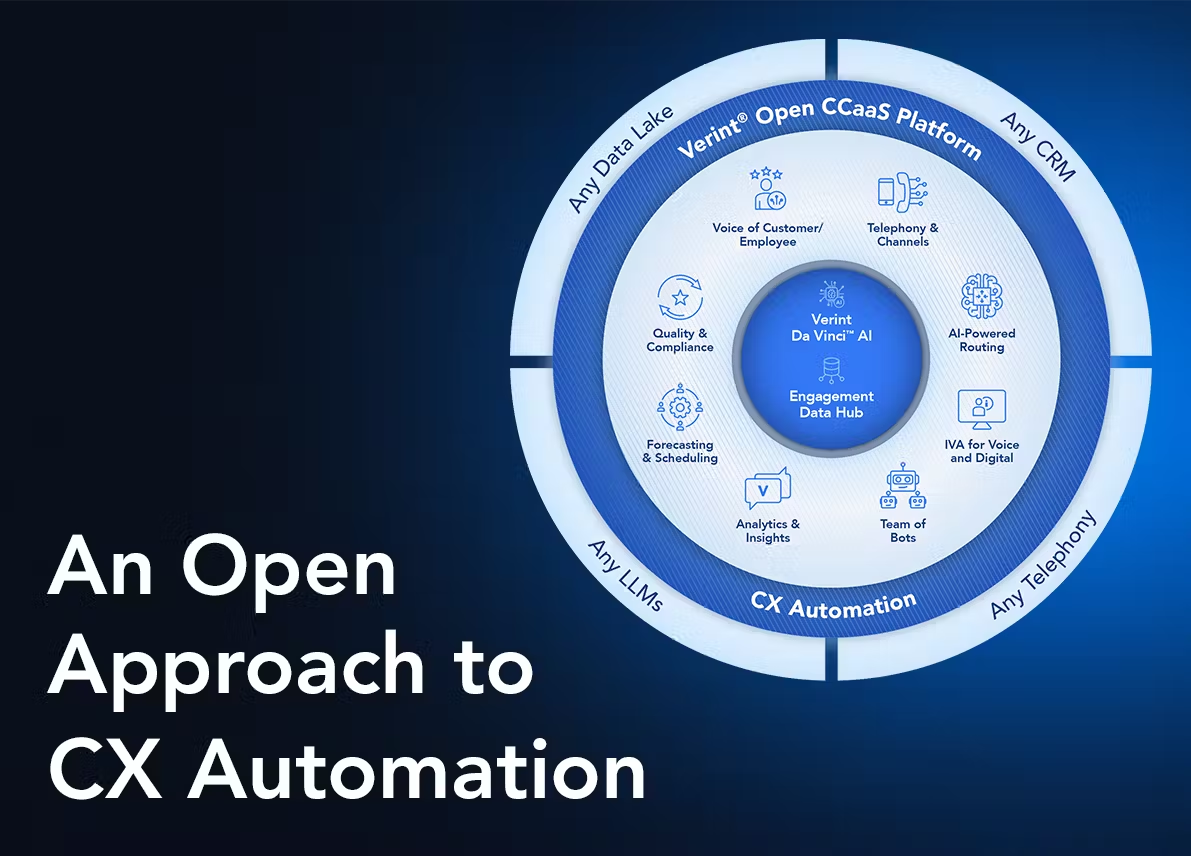

Evolving banking challenges require a new, open approach

Supercharge your bank branches: Maximize appointment booking

As more and more people are buying new products and services in person again, bank branches are returning to the spotlight.

Read our eBook to find out how you can:

- Improve customer experience and retention with appointment booking

- Increase sales and revenue in bank branches

- Drive efficiencies through automation

- Leverage insights from online appointment booking

With Verint, leading banks can

Increase sales and revenue in your branch

Connect CX to revenue

Deliver seamless experiences across telephony, digital, and physical channels

Unify data to improve CX

Find, retain, and empower your employees

Balance costs and service in your back-office

Prevent branch fraud, mitigate risk, and improve security

Master financial compliance

Increase sales and revenue in your branch

Connect CX to revenue

Deliver seamless experiences across telephony, digital, and physical channels

Your customers are increasingly going digital, so providing seamless customer experiences across all channels, bots, branches, and agents is key. Empower your customers to self-serve in your IVA, or easily transition to chat or voice without the need to repeat themselves. Intelligent routing ensures each interaction goes to the right resource, at the right time, for the best possible experience.

With Verint Telephony and Digital Channels solutions and AI-powered bots, you can streamline CX across all channels.

Unify data to improve CX

Understanding customer interactions and experiences is essential to your success. Our AI-powered Voice of the Customer solutions enable you to listen to your customers across every touchpoint – including, direct, indirect, and inferred sources.

Using Verint’s AI-powered Speech Analytics and Voice of the Customer solutions, VyStar Credit Union can understand their members’ experiences, analyze their sentiments, and proactively respond to their feedback from across channels. As a result, they’ve improved average speed to answer by 67.7% and increased member satisfaction by 7.5 %.

Find, retain, and empower your employees

Your operations are growing in complexity, with more communication channels, work types, and increasing customer expectations. We’ve made it easier to create accurate, omnichannel forecasts and flexible schedules to align employees with demand and work volumes across the enterprise.

We’ve added new AI-Powered Bots to help you find and hire the best candidates and keep your agents engaged with hyper-flexible scheduling. Check out the Verint Interview Bot and Verint TimeFlex Bot.

Navy Federal Credit Union uses Verint Workforce Management for Enterprises to create a One Workforce approach to their staffing.

Balance costs and service in your back-office

Slow turnaround times and processing errors in the back office directly impact CX. Verint Operations Manager solution is purpose built for back-office operations and provides real-time performance data on the work, your people and your processes.

The Work Allocation Bot automatically prioritizes and allocates work to the employee with the skills and availability to execute it. The solution continually rebalances work so that your service goals are cost effectively met.

Santander Bank UK was able to increase mortgage application processing speed by 20%, improve employee productivity by 25%, and boost NPS by 5%.

Prevent branch fraud, mitigate risk, and improve security

Verint is the leading provider of fraud prevention and security solutions for financial institutions. Identify risks and vulnerabilities in real time and help investigators mitigate threats, ensure compliance, and improve investigations.

From versatile and scalable network video recorders to robust video management software and more, our best-in-class security solutions can help keep your branches safe.

Master financial compliance

Keeping up with compliance requirements like Dodd-Frank, MiFID II, and MAR is complicated. Master regulatory adherence with a unified compliance platform complete with AI-powered speech transcription and analytics.

Saxo Bank chose Verint Financial Compliance to transform its compliance operations and navigate through complex trading regulations. With Verint, they can now record, secure, analyze, and understand all their regulated interactions across leading communication and collaboration platforms.

Banking Solutions

This is a carousel with slides that do not auto-rotate. Use the Next and Previous buttons to navigate.

Banking Customer Success Stories

Insights & Resources

Banking FAQs

As customer expectations rise, your organization must be able to provide seamless CX across telephony, digital channels, and even in the bank branch. But contact centers have gone digital, and technology has evolved. As the problem’s changed, the solution needs to change, too.

CX Automation lets you elevate customer experience without additional labor cost using AI. In other words, it lets you do more with less. Learn more about Verint Open Platform now.

As customers are getting more and more comfortable using digital channels, they’re making fewer trips to branches. Bankers need to be more proactive, and they must be able to make the most of the few face-to-face opportunities they have with their customers.

Verint has a wealth of banking solutions to help you align resources to market growth opportunities, dedicate time for outreach and business development, let your customers conveniently book face-to-face appointments with bankers, and more.

Today, customer experience is more important than ever. Customers are engaging with their banks through multiple channels, including phone calls, chat, and email. Financial institutions must be able to understand customer interactions and provide seamless CX across all channels, telephony or digital.

We can help you analyze your customers’ experiences across all touchpoints and drive CX automation to deliver AI business outcomes now.

Your staff is the backbone of your business, and the efficiency of your workforce greatly affects your customers’ experience. For this reason, employee engagement is crucial to the success of your bank.

From Forecasting and Scheduling solutions to the Verint TimeFlex Bot and more, we give you a range of AI-powered tools to drive employee satisfaction in the branch, back-office, and contact center.

Identifying and mitigating risks and vulnerabilities in real time and maintaining compliance with regulations is a complex task, especially in the financial industry, where special legislation further complicates the picture.

Verint can help you proactively manage potential fraud and risks and maintain compliance with specialist solutions fine-tuned for the capital and financial markets.