4 Common WFM Practices That Are Sabotaging Branch Sales

Many banks are struggling to hit their sales and revenue goals. In Verint’s most recent branch benchmark data analysis, we found that:

- On average, bankers are only spending 11% to 21% of their time on face-to-face customer sales interactions

- Bankers only spend 3% to 8% of their time on proactive revenue-generating activities.

But what if we told you the way you are staffing your branches could be sabotaging your efforts to generate sales?

What if you could double or triple the time bankers spend on sales interactions and revenue-generating activities?

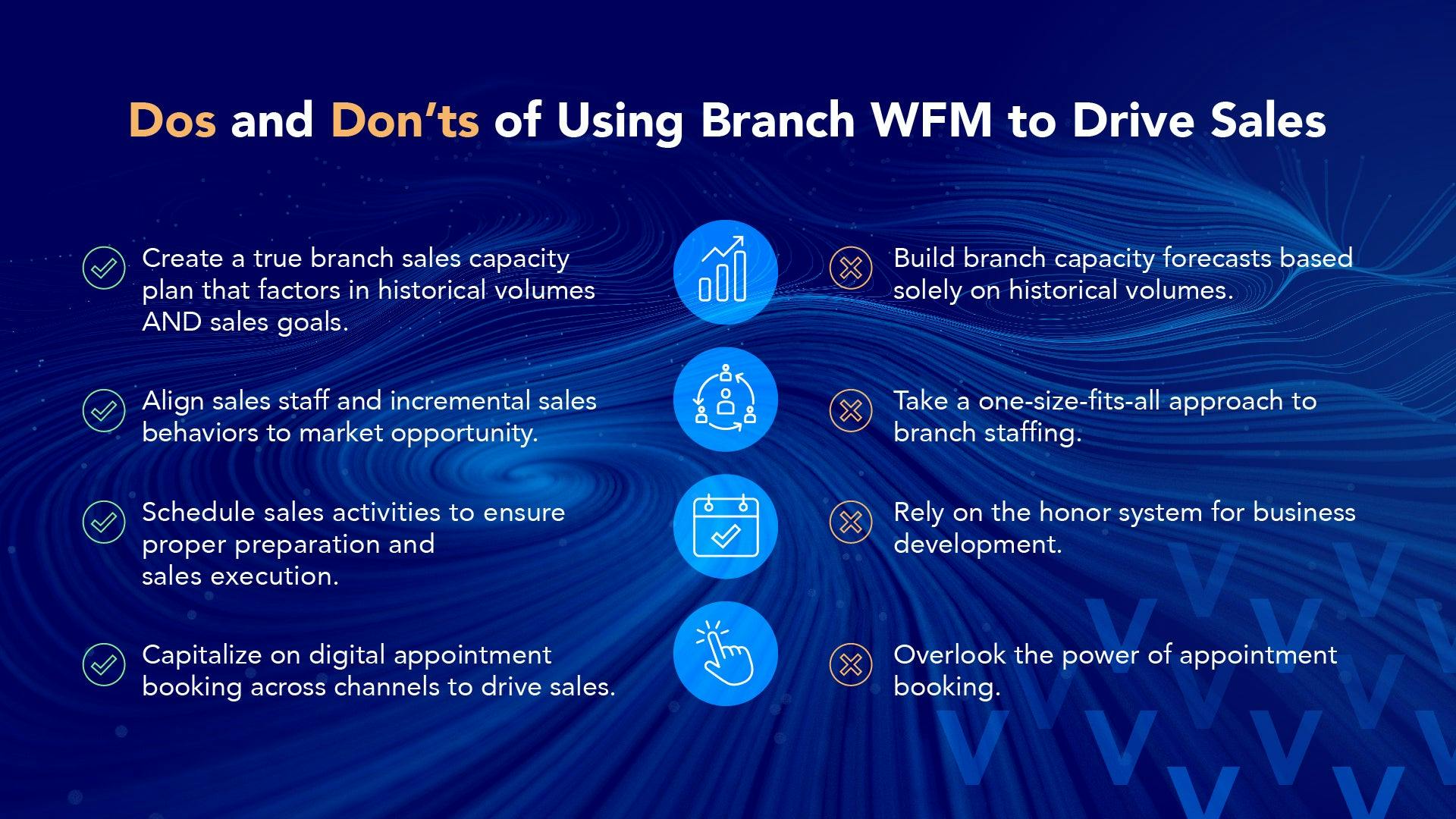

We’ve identified four “Dos and Don’ts” of branch workforce management (WFM). The “Don’ts” are common WFM practices that are preventing banks from capitalizing on their banker talent and customer interactions to drive sales.

1. Don’t build branch capacity forecasts based solely on historical volumes.

Forecasting based on historical volumes allows banks to predict the amount of work in each branch with high accuracy. However, to drive sales banks need to factor in not only historical volumes, but your sales goals by branch as well.

With Verint® Workforce Management for Branch™ you can now import monthly goals for any product at the branch level and adjust the forecast to meet your goals.

The forecast then applies the time associated with each interaction/product type, combined for all products. This gives you the total “selling hours” needed by branch, by month to achieve your sales goals.

Now you can compare your forecasts based on historical volume with the sales goal forecast to produce full-time equivalents (FTE) recommendations and ensure staffing is aligned to goals. This helps ensure you have enough sales staffing and the right type of staff to achieve your sales goals.

2. Don’t take a one-size-fits-all approach to branch staffing.

Instead of treating every branch the same and blanketing additional FTEs across the branch network, banks need to staff their branches to capitalize on market opportunity and drive business growth.

This way, they can ensure they have the capacity to perform the expected activities for business development and engage customers to drive sales and revenue.

3. Don’t rely on the honor system for business development.

Many banks trust that when not in front of a customer, bankers are conducting outbound calls, visiting businesses, or performing other types of business development activities.

But as we mentioned earlier, bankers are only spending 3% to 8% of their time on prospecting / outbound calling.

To ensure the desired sales and business development activities happen, banks need an automated workforce management solution that builds schedules that:

- Align your bankers to forecasted customer arrivals for sales discussions

- Block dedicated time for those revenue-generating activities such as business development and outbound calling

- Assign tasks down to the individual based on opportunity and skills

- Ensure these tasks are scheduled at optimal times to minimize impact on CX and operational requirements.

4. Don’t overlook the power of appointment booking.

Did you know sales sessions that are pre-booked appointments have a ~25% higher close rate than those without?

While many banks have a digital appointment booking solution, they are not maximizing its value by ensuring it’s easily found on their websites, mobile apps, and in chat and social medial platforms.

Banks can use the appointment booking interface to make it easier for customers to meet with your bankers.

The tool can also capture information on the customers’ intent, enabling the bank to share information with the customer prior to the appointment—including any documents needed or forms that can be filled out ahead of time.

The information also helps the banker effectively prepare in advance for that upcoming customer interaction. Together, this typically results in a deeper and more engaging conversation and better sales outcomes.

To dive more into the details of the dos and don’ts of leveraging Verint Workforce Management for Branch to drive sales, check out Jackie Hudson’s article in the BAI March Executive Report, Branches: Adapting for the Modern Customer.