With the publication of my column in the January 2022 issue of Contact Center Pipeline magazine, I officially announced to the industry my intention to retire this year. I have not renewed any client contracts for 2022 and have not initiated any new research, so I guess I’m really serious about this. I still have a couple of webinars to do during the first quarter of this year, and perhaps a little bit of blogging here and there, so I’m probably more semi-retired than retired at this point. But I’m getting there.

When it comes to the contact center industry, I think I’ve seen just about everything. I started covering the market when I took a job as an industry analyst at Dataquest in 1989. The contact center industry, or I should say call center industry, looked nothing back then like it does today.

When I struck out on my own and founded Saddletree Research in 1999, the industry was deep in the throes of what I recall as the industry’s first identity crisis. That was when just about every call center solution provider; i.e., vendor, desperately wanted to be a CRM vendor despite the fact that there were real CRM vendors, like Salesforce, already out there.

And who else remembers the next industry identity crisis? That was in the 2000s, when almost all call center vendors wanted to be e-Business companies. No, really. I’m serious. I recall one instance of pitching Saddletree Research services to a vendor during that period and when I followed up a few days later the marketing director told me they had decided to decline becoming a Saddletree client. When I asked why, she replied that I was “Too call center.” When I asked what business this ACD vendor was in if not the call center business, she replied, “We’re an e-Business company.”

Whatever.

These days I don’t mind being called “Too call center.” In fact, I’m kind of proud of it and that ACD vendor is long gone, absorbed into another company during the era of mass acquisitions, back in the mid-2000s. That era of consolidation didn’t help my business much as one client after another became acquisition targets and many times, the new owner company didn’t want to have anything to do with my boutique research firm.

Next came the era of the “name game.” That was the era wherein lots of contact center companies decided that they needed to change their company name. My suspicion was that for many of these companies, it was a last-ditch effort to stay afloat. When all else fails change the name. The more ridiculous the new name, the better. In some cases, we’re still witnessing this industry phenomenon today.

Speaking of unusual company names, one of my first clients when I started Saddletree Research was a little WFM company called Blue Pumpkin. They were as much an industry renegade as I was at that point, and I think the success of their little company spawned another industry fad—wacky start-up company names. Following the success of Blue Pumpkin, we saw the emergence of companies with names such as White Pajama, whose gimmick was to give away sets of white pajamas at trade shows, Red Hat, and Blue Martini. Unfortunately, Blue Martini didn’t have any giveaway gimmicks as best I can recall, but a martini bar on the trade show floor at the end of a long day would have probably gone a long way toward making that company more memorable!

Another fast-track company in the early 2000s was Witness Systems and I was fortunate enough to gain them as another one of Saddletree Research’s first clients. In 2004, Witness Systems acquired Blue Pumpkin, and although I lost a client in that acquisition, as two clients became one, I gained a business relationship that would stick with me through thick and thin for the next 23 years.

In 2007, Witness Systems was acquired by Verint in what was Verint’s largest acquisition at that point. I didn’t realize it at the time, but this acquisition was a true industry game-changer in that it spawned the development and popularization of what has become an industry staple—workforce optimization (WFO). Taking the best of what each of the acquired companies, including Blue Pumpkin, had to offer, and combining them into a unified offering on a single platform turned the industry on its ear. To this day, Verint still provides what I continue to refer to as the contact center industry’s gold standard of WFO.

It was at about this point in time that I started to realize that the industry was loosely, and I believe unintentionally, dividing itself into two broadly categorized camps—name-changers and game-changers. The game-changers are the companies that make a lasting and positive impact on the contact center industry. Game-changers are defined by their vision and their ability act on that vision to the benefit of the entire industry. Verint, for example, is the embodiment of a game-changer organization.

The name-changers, in my mind, are typically the companies that rely on clever slogans and nonsensical names rather than innovation to maintain an industry profile. While the game-changers are shaking up the industry with their creative solutions, the name-changers are turning to ad agencies to breathe life back into a company that probably would be dead if not for the recurring revenues from the maintenance of their installed base.

While a lot has changed in my 33 years in the industry, I’m sorry to say that there are some aspects of the contact center industry that haven’t changed much at all. For example, as long as I can remember, the contact center has worked toward raising its profile within the organization. I think most of us will agree that the contact center should be viewed by the enterprise as a profit center and the first line of defense in the fight for customer retention.

Unfortunately, I’ve found that most companies still view the contact center as a cost center rather than a profit generator, which makes no sense at all, but that’s still the way it is. As a further proof point of this general attitude, take a look at this response to one of the questions in our 2021/22 survey of contact center professionals.

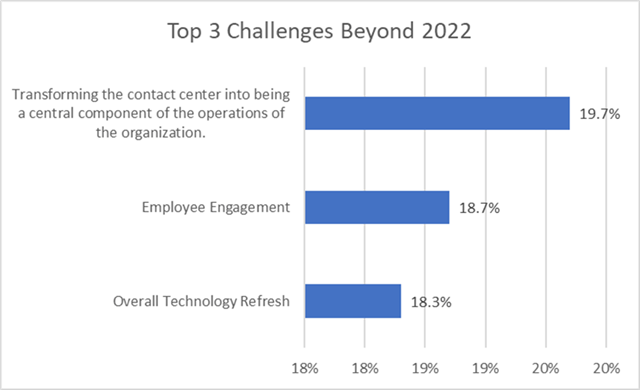

We asked our survey participants to go through a laundry list of potential challenges for 2022 and beyond and pick their top three. The results are illustrated below.

Source: Saddletree Research

As you can see, the same challenge that existed 30 years ago still exists today—how to raise the profile and perceived value of the contact center within the enterprise. The solution to this problem may lie in the generational turnover of contact center management in the future. As the older generation of managers retire or are replaced, they will take their old-school attitudes toward the customer service function with them. Next generation managers will bring a different attitude toward the customer service function with them which will, I believe, positively impact the contact center

On the other hand, I’m pleased to see employee engagement taking its rightful place as a top concern for contact center management this year, and beyond. For too many years, contact center agents were considered disposable assets and as long as there was a steady flow of warm bodies coming through the door to fill those vacant contact center seats, all was right with the world.

The value of the agent employee has risen, and will continue to rise, in the industry. The industry’s historically high turnover rate will become a phenomenon of the past. It will have to. As labor markets continue to tighten, as they are expected to, the industry will have to take unprecedented measures to retain employees via increased morale, reward, recognition, and career advancement possibilities.

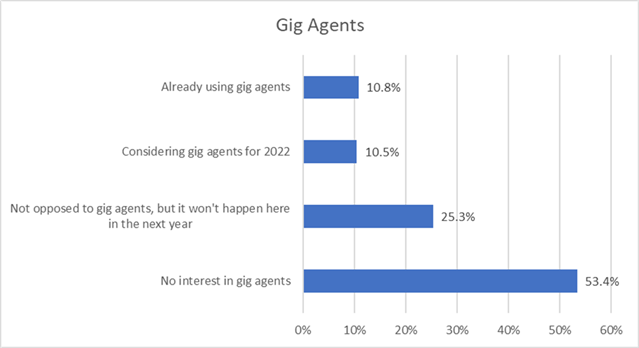

The industry will also have to embrace the changing profile of the workforce, including the inclusion of gig workers. In our 2021/22 survey of contact center professionals, one of the questions we asked was in regard to attitudes and intentions toward gig, or independent contractor, agents in the contact center. The results are illustrated in the graph below.

Source: Saddletree Research

At this point, it seems that the industry is evenly divided in terms of attitudes toward gig workers with about half the industry on the positive attitude side and the other half with no interest in gig agents. I believe that the 53 percent of the industry with no current interest in gig agents are about to undergo a rude awakening. As the data shows, gig agents are unquestionably becoming an integral part of the contact center industry. Those with doubts about the value of gig agents will need to jump on the bandwagon soon or prepare to get run over.

One final thought before I ride off into the sunset. Automate.

I understand that a lot of contact center executives are reluctant to turn over their self-service function to intelligent virtual agents (IVAs), or bots, but the time has come to turn that corner. For many years bots have been nothing more than glorified FAQs, but those days are over and the era of the IVA is here. As labor gets harder to secure, the industry will have to turn to automation to fill in the live agent gaps.

IVAs will also act as on-site, real-time agent assistants for those agents who continue to work from home in the future. Now that the industry has embraced the work-from-home (WFH) agent concept en masse, there is no turning back. Recalling our survey results regarding employee engagement, the industry will have to continue to find and implement strategies and technologies to support remote employees so that they still feel a part of the organization.

The COVID-19 pandemic has forced the industry to evolve faster than I thought it would. I think we’ve seen about ten years of industry evolution packed into the last couple of years, and that’s not necessarily a bad thing. The industry is being forced to modernize fast and to work with a fluid definition of employee and customer engagement. As a contact center professional, you’ll have some important decisions to make in the very near future, especially when it comes to deciding which technologies will be critical to your contact center’s success in the future. What to buy, how to buy, who to buy from, etc.

If I could leave you with one piece of advice when it comes to your technology acquisitions and vendor partner selection in the future, it would be this: If you have to choose between a game-changer and a name-changer, take the game-changer every time.