What FIs Need to Do to Adopt New Bank Branch Operating Models

Recently, Verint sponsored a survey, conducted by Arizent, the research arm of American Banker, to understand how financial institution (FI) branch banking executives are evolving branch operating models to align to corporate objectives. Access the findings here.

In this blog, I’ll share the survey results, information about new operating models, and guidance for what you can do to prepare for change and effectively utilize branch resources in these new branch environments.

First, let me share some of the survey findings.

Arizent February 2022 Bank Branch Operating Model Survey

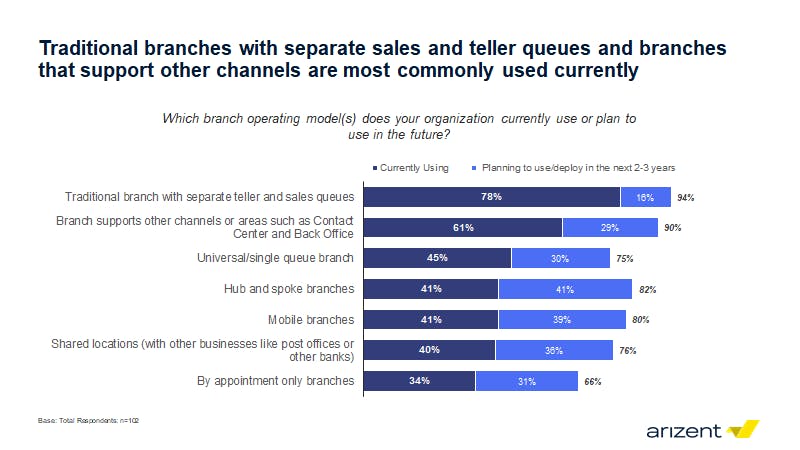

Banks are planning for operating models that are different from the traditional, two-queue branch format and realize that more than one model will be needed to optimize their branch networks to align with their strategy. For example:

- Single Queue: 45% are using a single queue / universal layout model, which will expand significantly to 75% in the next 2 to 3 years. This model helps with efficiency and customer experience in lower volume locations.

- Multi-Channel: 61% of respondents have been leveraging branch capacity to support other channels, such as the contact center, digital, or back office. The cross-functional use of resources was initially driven by the pandemic but is emerging as a means to support a spike in interactions wherever they occur in the enterprise.

- Hub and Spoke: 41% are using a hub and spoke model in parts of their network, a number that is expected to double in the next 2 to 3 years. A hub and spoke model supports sharing resources, branches working as a “unit” to serve a market, and the transition in focus from service to sales. The primary full-service branch is the hub and the smaller surrounding branches are spokes, with shorter hours, alternative means for routine transactions, and a heavy sales focus.

- Appointment Only: 34% of respondents have existing appointment-only branches, with 31% planning on adding them to their branch mix. Appointment-only branches enable bankers to prepare for the interaction to maximize sales potential and best enhance the customer relationship. This branch model also compliments other operating models, giving customers access to bankers in areas that financially don’t support a full branch.

- Mobile Branches: Similarly, 41% are using mobile branches, with another 39% planning on deploying them in the next 2 to 3 years. Mobile branches offer a great deal of flexibility in serving markets where there is not enough foot traffic to support a brick-and-mortar branch.

Source: Evolving Bank Branch Operating Models Require New Approaches to Staffing, American Banker, June 2022

Setting Up Your FI for Success

The move to the newer branch operating models is contingent upon employee skills, availability, your systems and processes, and your approach to branch workforce management. Following are a few suggested actions to help ensure successful deployment of these models.

Hire multi-skilled, flexible employees for blended roles

The sharing of resources across channels, branches and having blended roles means you will need to hire multi-skilled and multi-faceted employees who are flexible and comfortable with changing their work focus and even location.

Provide access to systems

To support different channels and areas across the enterprise, branch employees will need access to and training on those groups’ systems. This effort will take time and coordination with IT, HR, L&D, the relevant functional areas, and more. The ability to share resources won’t occur overnight, but as the pandemic proved, it can happen at a much faster pace than anyone in banking ever thought.

Define market clusters or communities to support resource sharing

To effectively share resources across branches, you will need to define the branch groupings by proximity to resources and identify employees who are comfortable working in more than one location. There are also operational considerations, like being able to charge the employee’s time to the proper cost center, assigning cash drawers if the branch has cash and the employee is going to handle it, and more.

Have an effective change management plan

As with any change, a comprehensive transition plan needs to be developed. Testing new branch operating models in a subset of branches first will allow an FI to gain key learnings in order to make adjustments prior to full deployment. Changes may be required in the mix of branch types and roles, staffing and scheduling, role expectations, customer communication, and more.

Understand staffing needs

New branch operating models create challenges but also opportunities to more effectively deploy your branch resources to meet your efficiency, sales, revenue and customer experience goals. Before banks start investigating new branch operating models, they need to understand how efficient their existing models are and the impact of changing to new models.

For those without an automated branch workforce management solution, Verint offers many business consulting and branch optimization services delivered by experts in the branch banking field. For example, in a Verint® Strategic Staffing AnalysisSM we evaluate your actual staffing levels, compare them with those that will be required to put new models in place, and make recommendations on how best to transition staffing to align with new branch formats across your entire branch network.

Learn more about Verint® Strategic Staffing AnalysisSM consulting offering.

Banks with an automated branch workforce management solution can use the solution to inform their branch operating model strategy and can effectively address the complexity and variability of staffing requirements. Senior banking executives, market leaders and branch managers will feel confident their branches are properly staffed, and they have plans that can adapt to changes in strategy, consumer behavior, and market demands.

Verint Workforce Management for Branch™ solutions can automate demand forecasting, capacity planning and resource scheduling to optimize branch staff utilization and align resources to your efficiency, growth, and customer experience goals.

Want to learn more about the priorities and challenges of bank branch executives? Download the Arizent research report: Evolving Bank Branch Operating Models Requires New Approaches to Staffing.