BNP Paribas Automates Objective and Consistent Quality Assurance with Verint

BNP Paribas supports 3.9 million customers through a network of almost 460 bank branches

Results

Agent quality increased by 38% in five months.

Promotion of digital channels increased by 63%.

Paraphrasing increased by 20% in 11 months.

Reduced risks by automating the entire quality management process.

Achieved objective and consistent quality assurance and coaching.

About BNP Paribas

Ensure a consistently rewarding customer experience

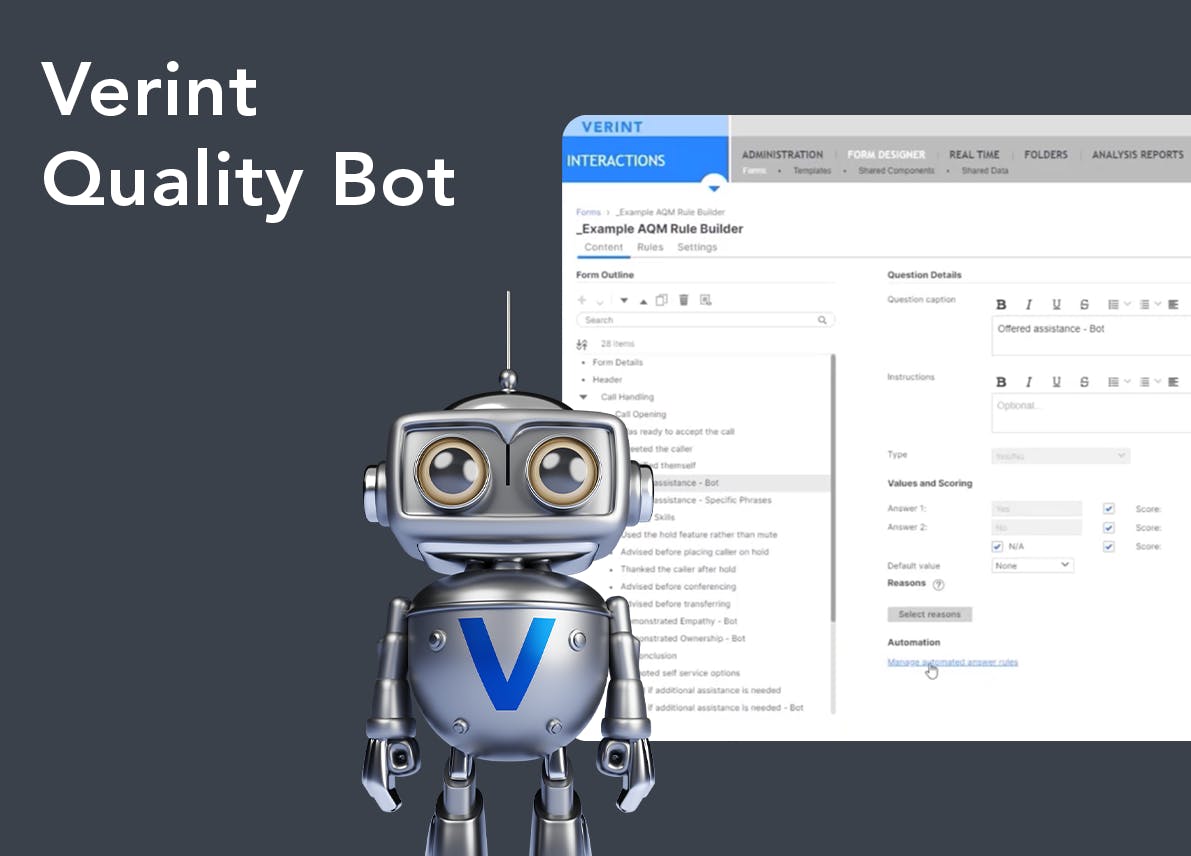

Evaluate large numbers of interactions with Verint Quality Bots*

In response, BNP Paribas has deployed Verint Quality Bots. This modern, forward-thinking quality assurance solution enables the Bank to understand what is happening on the calls that were previously unevaluated, sharing insights automatically among quality management decision-makers, agents, and other stakeholders.

BNP Paribas has the flexibility to select and evaluate large numbers of interactions across channels based on criteria such as relevance, employee performance, and customer input. Mateusz Menich, Senior Speech Analytics Specialist, BNP Paribas, explains, “Verint Quality Bots are an innovative way to gain insights that would be difficult – potentially impossible – to achieve by randomly sampling small numbers of interactions and evaluating them against inwardly focused metrics and processes.”

Verint Quality Bots, seamlessly connected to Verint Performance Management, plays a vital role in BNP Paribas’ new “Digital Channels Promotion.” This is a contact center campaign to promote increased digital channel use among customers and help close the engagement capacity gap: the difference between the resources available in the contact center to meet rising digital demand and the exploding volume of customer interactions and communication channels.

The Verint solution automatically delivers the desired type and number of agent/customer interactions to be evaluated for each employee based on business rules. For example, how frequently and effectively the agents promote the digital channel for an email/address change, password reset, or card activation.

This is a carousel with slides that do not auto-rotate. Use the Next and Previous buttons to navigate.

Benefits

Verint Quality Bots deliver consistent quality assurance

Drive real-time action with the Verint Platform