Branch Banking Consulting Services

Customized advisory services that drive retail bank transformation

Branch Banking Consulting Services

![]()

Value-Added Implementation Services: achieve faster time to value

Quickly adapt branch staffing to market changes

Learn how a Strategic Staffing Analysis can help you better align your resources to your branch strategy and more quickly adapt to industry, economic, and customer changes.

Learn MoreBranch Field Studies: gain visibility into branch performance

Many financial institutions have little visibility into how their branch staff are spending their time, making it difficult to identify process, customer, or staffing issues.

A Verint Branch Field Study℠ helps you understand what activities and behaviors are occurring in your branches. Our banking experts conduct in-branch observations across a representative sample of locations. We compare this data with our library of best practices and standards gained from working with hundreds of branches and financial institutions across the globe. By analyzing a host of factors, such as customer arrivals and wait times, branch workflows, staff utilization, sales, service and non-customer-facing activities, we can help you quickly identify opportunities for improved efficiencies and enhanced CX.

A Branch Field Study can help banks and credit unions:

- Quantify how time is being spent in the branch, both customer-facing and non customer-facing work.

- Understand if new roles are performing as designed.

- Update the time standards in branch staffing models.

Our observations can also capture the types of conversations occurring in your branches. For example, if educating customers on digital service options is a strategic initiative, a Branch Field Study can capture and assess if these conversations are happening in your branches.

Learn how First Horizon Bank benefited from a Verint Branch Field StudyPosition Planning: optimize the position mix for each branch

Position Planning can help banks and credit unions:

Strategic Staffing Analysis: position branches for sales growth

The shift to digital channels for many service activities and the changing expectations of consumers for more financial advice and guidance from their bank branch, banks have had to be more agile in how they staff, and what services they offer in their branches.

In a Verint Strategic Staffing Analysis℠, our branch banking experts use our proven forecasting and capacity planning software create analytics-based, recommended branch staffing levels for financial institutions that might not be ready to implement branch workforce management software. Using our industry leading WFM for Branch software, we propose realistic and actionable staffing recommendations for each branch to best address customer demand, service levels, and market opportunity for growth while maintaining efficiencies.

A Strategic Staffing Analysis gives you a snapshot of your branch staffing – A great first step on your workforce management journey. A SSA enables you to:

- Evaluate staffing needs by comparing actual FTE to budgeted FTE to recommended FTE.

- Compare teller and platform activities to industry standards.

- Determine FTE needed for absence coverage: float pools and/or shared resources.

- Understand potential FTE reallocation across the branch network:

- Identify branches at risk and in need of staff to avoid potential customer service issues.

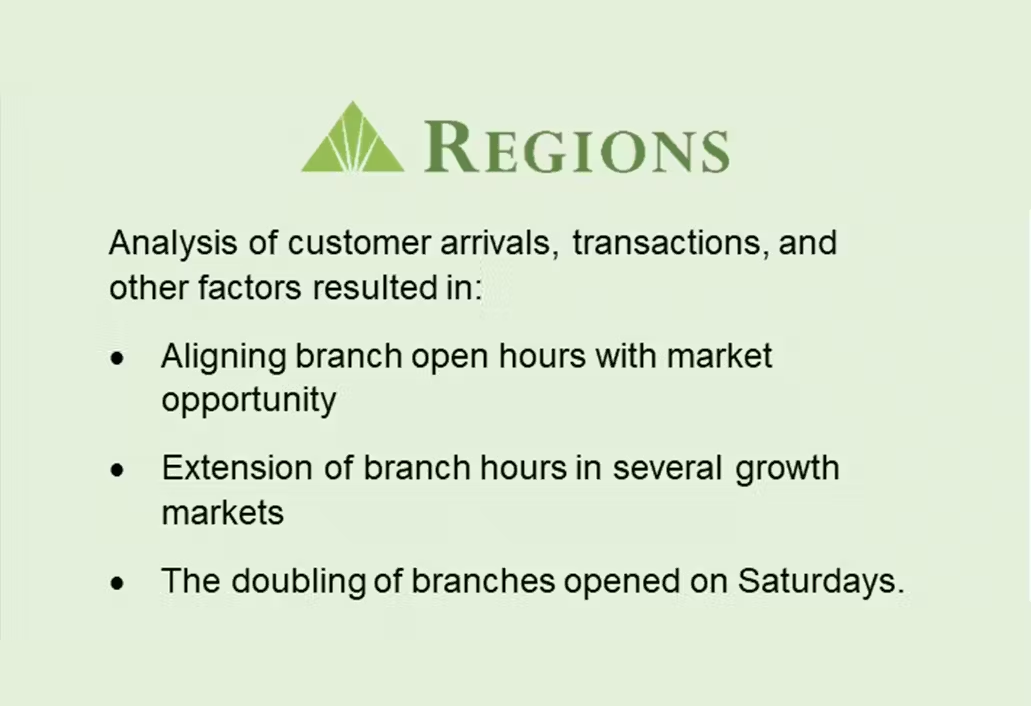

Open Hours Optimization: optimize service, opportunity, and cost

An Open Hours Optimization Engagement provides banks and credit unions with:

This is a carousel with slides that do not auto-rotate. Use the Next and Previous buttons to navigate.