4 Ways Health Insurance Companies Can Provide a Better Member Experience—Backed by Research

The global COVID-19 pandemic layered new challenges on top of an existing tough market for U.S. health insurance companies. These companies had to quickly activate emergency plans to ensure people had access to prevention, testing, and treatment for COVID-19. When vaccines became readily available, health insurers then turned their focus to improving vaccine acceptance and access for their members.

At the same time, health insurers experienced financial pressures due to uncertainty around premiums and client companies struggling or even going out of business. Throughout, health insurers had to educate their employees during a constantly changing landscape.

No doubt the member experience was tested, as the constant changes created confusion for both members and employees, putting pressure on both the contact center and digital self-service support channels. However, our research in the recently released Verint Experience Index: Health Insurance 2021 report shows that the top 25 U.S. health insurers delivered on the member experience across channels. The range for satisfaction scores from highest to lowest in the rankings was just under 9 points, suggesting that all the top 25 health insurers are highly competitive when it comes to member satisfaction.

Here are some other interesting findings from the research and how health insurers can apply them to provide a better member experience.

- Drivers of Satisfaction

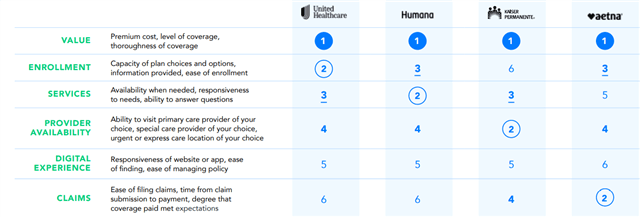

What the Research Shows: Members across the board care about the value of their plans, but other factors that influence satisfaction vary a lot across companies. It means that not only do members fluctuate in their needs, but insurers differ in what they provide.

Member Experience Tip: It’s critical for health insurance companies to understand what will drive their members’ satisfaction—not just look at and automatically follow marketplace trends. Using the right methodology will allow health insurers to know exactly which drivers most impact their members’ satisfaction and Net Promoter Score (NPS).*

- Channel Preferences

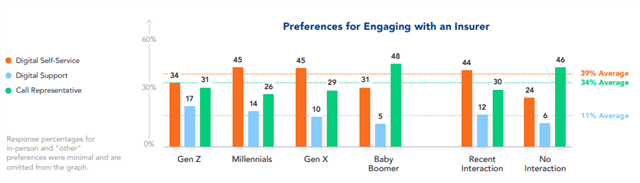

What the Research Shows: Members prefer digital self-service, digital support, and call center channels for the same reasons—but some generational behaviors might be surprising. For instance, Baby Boomers aren’t the only ones who call into the contact center, and Gen Z doesn’t always prefer digital channels.

Member Experience Tip: Don’t assume specific generational cohorts will engage in certain channels with you based on stereotypes. Health insurers need to implement a true omnichannel strategy—one that engages with members depending on their individual preferences and where they are most comfortable. In other words, engage with members where they want.

- Telehealth Offerings

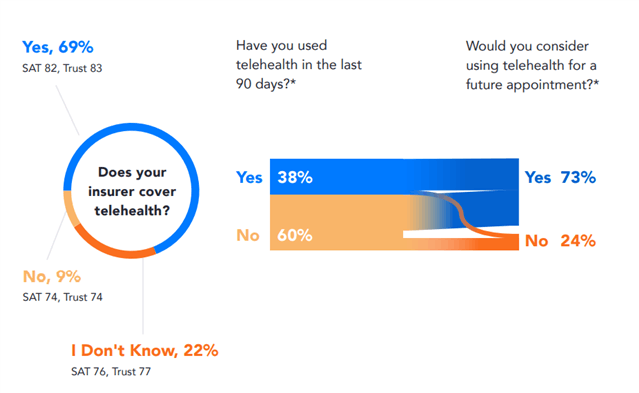

What the Research Shows: Members who know their insurance provider covers telehealth are more trusting and more satisfied, but 31% of respondents think either that their provider doesn’t cover these kinds of appointments, or they aren’t sure if they do. Even among members who have not recently used a telehealth appointment, 65% would consider using one in the future. Members who said their insurance provider covers telehealth have a 12% higher trust score for their insurer.

Member Experience Tip: People want to use telehealth services. Despite telehealth launching with a rough start for a lot of providers, it’s not going anywhere and will continue to grow in popularity. Health insurers should cover it and make sure that their members know whether it’s covered and under what circumstances.

- When Members Engage

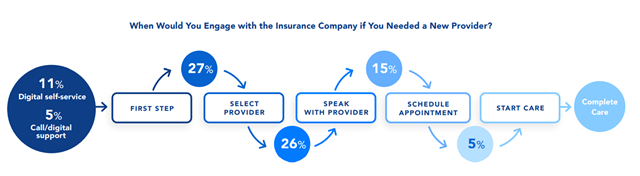

What the Research Shows: We asked respondents at what point they would engage with their health insurer if they needed a new healthcare provider. More than half said they would engage with health insurance companies before they speak to their healthcare provider. Only 11% said they wouldn’t engage with their health insurer at all.

Member Experience Tip: It’s important that members engage with their health insurer at the right time. The research didn’t show consensus on when that is, so health insurers have a huge opportunity to define this process better. Is it something that insurers can educate their members on? What channels should insurers be using to engage? How can companies make the process easier for their members? Health insurers should find the answers to these questions within their member experience data—and then act on that insight.

Focus on the Member Experience to Stay Ahead

The pressures on organizations and the member experience created by the pandemic aren’t going away anytime soon. As the delta variant causes cases to climb and talk of vaccine boosters continues, health insurance companies will need to be ever vigilant.

Teams across organizations will need to be in constant communication with one another to discover issues that arise for members and then quickly act. Now is the time for health insurance companies to take stock of their experience management program to make sure it’s capturing all the necessary insights across the contact center, digital self-service, and digital support channels—and connecting the data across departments to break down silos and fill gaps.

*Net Promoter, Net Promoter System, Net Promoter Score, NPS and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.