Riyad Bank increases NPS score by 25% with Verint

The Results

Increased NPS score by 25%

Achieved 50% reduction in customer loan application process time

More than 200,000 surveys completed yearly

Opportunity

New ways to capture, analyze, track, and act on customer feedback

This is a carousel with slides that do not auto-rotate. Use the Next and Previous buttons to navigate.

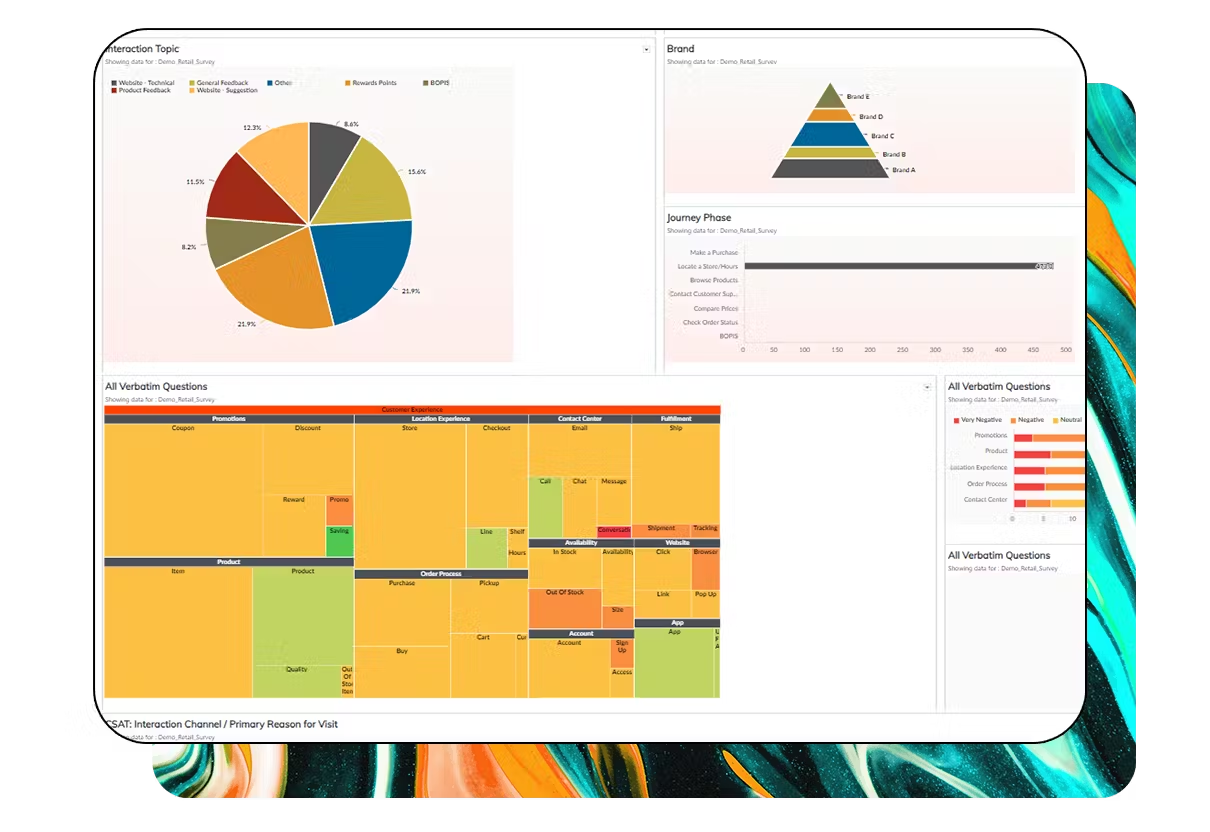

The Solution: Verint Experience Management

This is a carousel with slides that do not auto-rotate. Use the Next and Previous buttons to navigate.

The Benefits: A game-changing customer engagement system

- Raised the NPS score by 25 percent.

- Significantly reduced application process time for auto loan, personal loan and mortgage loan applications.

- Grew the volume of surveys to more than 200,000 annually (120,000 of which are from the monthly NPS study).

- Improved the quality of surveys as measured by the bank’s internal CX maturity survey by “a significant amount”.

- Enhanced customer satisfaction through “closed loop” customer case management.

- Embedded NPS and customer satisfaction into the bank’s service improvement activities.

- Awarded the Mohammed bin Rashid Al Maktoum Award for Excellence in Customer Service in 2021 and “Best CX and Operational Excellence” and “Best CX Leadership” at CX Live Awards for Middle East and Africa.

- Redeployed eight staff previously managing the feedback process to other departments, with a commensurate cost saving.

- Shared the NPS data intelligence with multiple teams (including UX, service design, and business process quality teams) to improve the multichannel customer journey

- Captured feedback to deeply understand every customer touchpoint

- Linked feedback data with other customer data to generate deeper insights

- Increased the feedback response rate from one percent to eight percent

This is a carousel with slides that do not auto-rotate. Use the Next and Previous buttons to navigate.